The Intricacies of After-Hours Trading: An In-depth Exploration

If you’ve ever been curious about what unfolds in the financial realm once the standard trading hours come to a close, prepare to embark on a journey into the intriguing world of after-hours trading.

This comprehensive guide endeavors to offer a thorough, enlightening, and meticulous exploration of this often overlooked aspect of the stock market.

Understanding After-Hours Trading

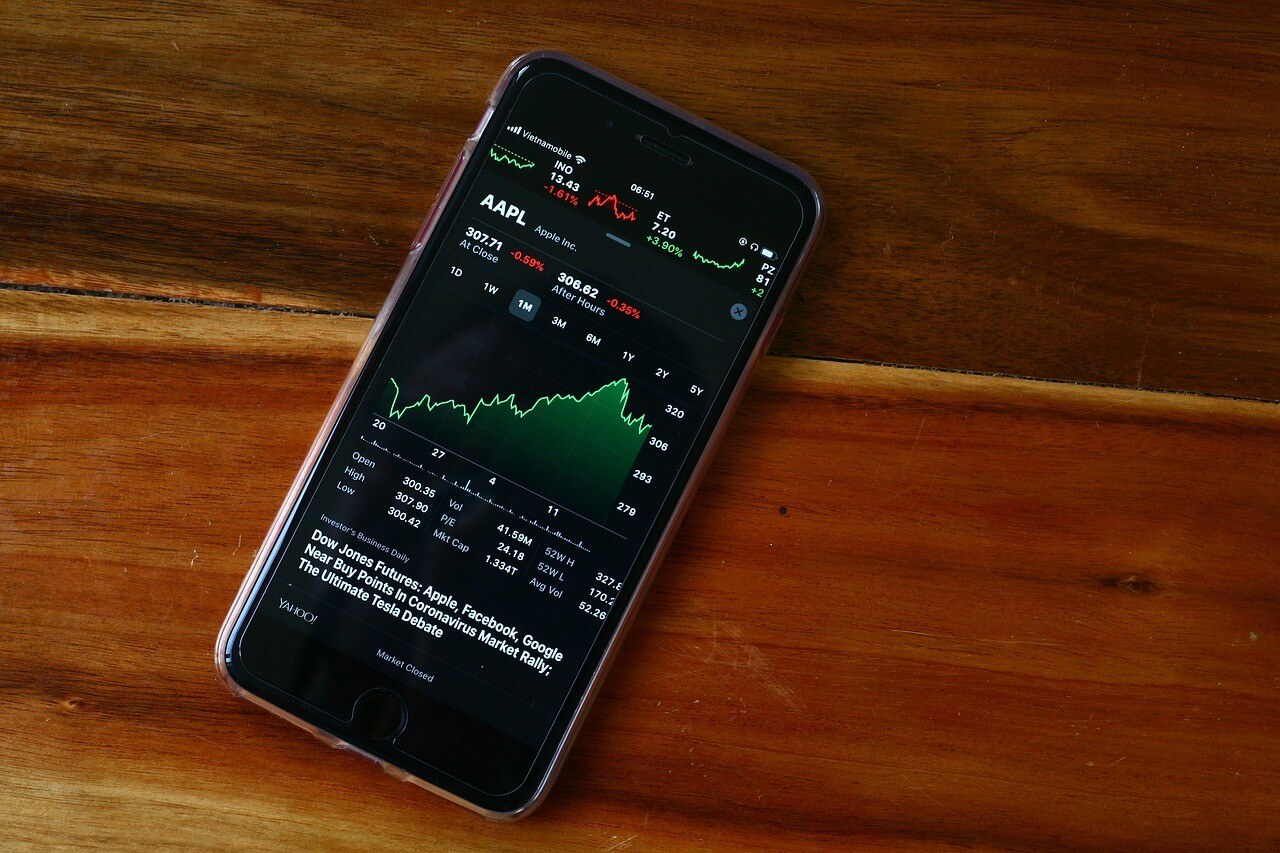

The concept of after hour trading refers to the buying and selling of securities outside the standard trading hours of a stock exchange.

In the United States, most stock exchanges, including the New York Stock Exchange (NYSE) and NASDAQ, operate within the timeframe of 9:30 a.m. to 4:00 p.m. Eastern Time (ET). After-hours trading, on the other hand, unfolds during the period from 4:00 p.m. to 8:00 p.m. ET, establishing this timeframe as the after-market session.

However, it’s important to emphasize that trading activity isn’t confined exclusively to these hours. Transactions indeed take place after the official market closing time, courtesy of the presence of electronic communication networks (ECNs), which facilitate this extended trading capability.

Trading Sessions: Regular vs. After-Hours

Within the financial realm, a trading session signifies the duration when the market is active, representing a single business day’s cycle. The start of a session is signified by the ringing of the opening bell, marking the market’s commencement, while the conclusion is indicated by the ringing of the closing bell, denoting the session’s conclusion.

While the majority of trading activities unfold during regular hours, the after-hours session introduces a distinct array of opportunities and complexities for investors. This timeframe allows investors to respond to breaking news and capitalize on potential market shifts that may not be feasible during standard trading hours.

The Role of Electronic Communication Networks (ECNs)

The emergence of Electronic Communication Networks (ECNs) has brought about a profound transformation in after-hours trading. These networks serve as a platform where potential buyers and sellers can connect, bypassing the necessity for a conventional stock exchange. ECNs play a crucial role in after-hours trading by facilitating the matching of orders based on specified limit prices.

However, it’s essential to recognize that after-hours trading typically witnesses lower trading volumes, with a diminished number of active traders during this timeframe. This scenario can undergo a dramatic shift if noteworthy economic news emerges or if a company encounters an unexpected development, leading to a surge in trading activity.

Who Can Trade in the After-Hours Session?

Initially, US stocks after-hours trading was predominantly utilized by institutional investors. However, the democratization of financial services, spearheaded by ECNs, has enabled individual investors to participate in after-hours trading sessions.

Risks and Advantages of After-Hours Trading

As with any financial endeavor, after-hours trading comes with its own unique blend of advantages and disadvantages. Among the potential risks are factors like decreased liquidity, owing to lower trading volumes, and wider bid-ask spreads resulting from reduced participation. Additionally, the presence of institutional investors can add an element of heightened competition. Notably, the after-hours market tends to exhibit greater volatility, which can translate into significant price swings.

However, after-hours trading also boasts several merits. It empowers investors to make trades based on the latest information, potentially offering access to more favorable pricing opportunities. Furthermore, after-hours trading delivers added convenience, particularly catering to those who prefer to engage in trading during non-peak hours.

Analyzing the Influence on Opening Prices

The after-hours trading session holds the potential to exert a notable influence on a stock’s opening price when the next regular market session begins. This influence becomes particularly pronounced if a stock undergoes significant price fluctuations amid robust after-hours trading volumes, as these movements often carry forward into the following day’s regular session.

Brokerages Offering After-Hours Trading Services

Diverse Brokerages Providing After-Hours Trading Services Various brokerages offer a range of after-hours trading services, each with its distinctive features. For instance, Robinhood extends its trading hours by an additional half-hour before the market opens and continues for two hours after it closes.

In contrast, Fidelity permits after-hours trading until 8 p.m. and accommodates pre-market trading between 7 a.m. and 9:28 a.m. TD Ameritrade stands out by offering round-the-clock trading, available five days a week, and not limited solely to U.S. securities. E*Trade, WeBull, and Schwab also provide extended hours trading

Trading Schedules for After-Hours Sessions

The standard timetable for after-hours trading sessions typically unfolds as follows:

- Pre-market: 4 a.m. – 9:30 a.m. ET

- Post-market: 4 p.m. – 8 p.m. ET

- Days: Monday through Friday

- Exchanges: New York Stock Exchange & NASDAQ

Strategies for Successful After-Hours Trading

While after-hours trading presents unique opportunities, it also requires a different trading strategy. Here are a few tips for successful after-hours trading:

- Stay Informed:

Keep abreast of the latest news and announcements, especially those that are released after the closing bell.

- Use Limit Orders:

Given the volatility of the after-hours market, using limit orders can help control the prices at which you buy and sell securities.

- Manage Risk:

Be aware of the risks involved and manage them accordingly. This can include setting stop-loss orders to limit potential losses.

- Monitor Spreads:

Pay close attention to the bid-ask spread, which can be wider during after-hours trading.

- Be Patient:

Lastly, be patient. Successful trading requires discipline and a long-term perspective.

Finally,

After-hours trading offers a distinctive landscape filled with opportunities and challenges for investors. Through a comprehensive understanding of its nuances and a disciplined approach, investors may unlock substantial advantages within this less-explored realm of the stock market.

Nonetheless, akin to all investment endeavors, it remains paramount to conduct thorough research and grasp the associated risks before taking the plunge.